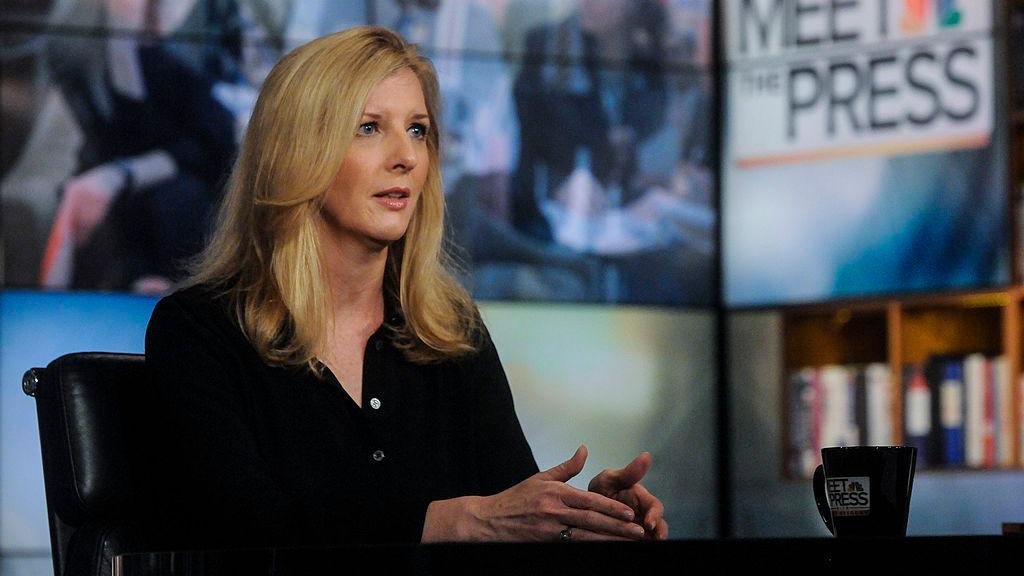

Goldman Sachs’ former general counsel, Kathy Ruemmler, built a career that many lawyers would consider extraordinary. From prosecuting corporate giants to advising a U.S. president, her résumé reflected influence, prestige, and years of public service. But a wave of newly released documents revealing her ties to disgraced financier Jeffrey Epstein ultimately brought that career chapter to an abrupt close.

The unfolding controversy — now widely described as Gifts and Soup From ‘Uncle Jeffrey’: How Epstein Connections Derailed Kathy Ruemmler’s Bid at Goldman Sachs — has sparked fresh questions about judgment, ethics, and reputational risk at one of Wall Street’s most powerful institutions.

A Career Marked by High-Profile Roles

Before joining Goldman, Ruemmler earned national recognition as a federal prosecutor. She played a key role in securing convictions against Enron executives, including Ken Lay and Jeffrey Skilling, in one of the most significant corporate fraud cases in U.S. history.

Her reputation for legal rigor carried her into public service. During Barack Obama’s presidency, Ruemmler served in several senior legal positions, including as White House Counsel. At one point, she was even floated as a potential candidate for U.S. attorney general — a testament to her standing in Washington.

After leaving the White House in 2014, she returned to private practice and later joined Goldman Sachs in 2020. By 2021, she had risen to become the firm’s top legal officer.

Emails That Told a Different Story

For years, Ruemmler characterized her relationship with Epstein as strictly professional, rooted in her work as a private defense attorney. She publicly described him as a “monster” and expressed regret for ever having known him.

However, thousands of newly reviewed documents suggest a far more personal dynamic.

Roughly 8,400 files either referenced Ruemmler or directly involved her. The correspondence went well beyond legal strategy. Emails revealed casual banter, social planning, shared jokes, and personal conversations about dating and career frustrations. In one 2015 message, Ruemmler wrote warmly about Epstein, comparing him to an older sibling.

The tone of the exchanges often appeared informal and friendly — a stark contrast to the strictly transactional relationship she had previously described.

Lavish Gifts and Personal Gestures

News reports had already documented luxury gifts Epstein gave Ruemmler, including Hermès handbags, spa treatments, an Apple Watch, and a Fendi coat. The new documents provided additional context.

In one instance, Epstein prepaid for a spa treatment for her. In another, he arranged to send flowers and chicken soup when she wasn’t feeling well — prompting affectionate thanks that included the nickname “Uncle Jeffrey.” His assistant even remarked in one email that seeing Ruemmler happy made him happy.

These exchanges, while seemingly personal and even mundane, occurred years after Epstein’s 2008 conviction on sex crimes charges, when he had already become a registered sex offender.

The revelations complicated the narrative that their relationship had been limited to legal counsel.

Awareness of Allegations

Some documents suggest Ruemmler was aware of the seriousness of allegations Epstein faced in Florida involving underage girls. In certain exchanges, she appeared to advise him on public relations strategies — offering suggestions about how he might attempt to repair his reputation or respond to fresh accusations.

When Epstein was arrested again in 2019 on federal sex trafficking charges and later died in a Manhattan jail, Ruemmler had reportedly been involved in aspects of his legal defense efforts.

The timeline — particularly the continuation of contact after his conviction — intensified scrutiny over her judgment.

Wall Street’s Code of Conduct

On Wall Street, the appearance of impropriety can be as damaging as misconduct itself. Financial institutions maintain strict policies governing gifts between clients and executives. Goldman Sachs requires employees to obtain approval before giving or receiving gifts from clients, partly to ensure compliance with anti-bribery regulations and to avoid conflicts of interest.

While Goldman’s leadership initially expressed public support for Ruemmler, reports from outlets such as Bloomberg and The Wall Street Journal indicated that some of the firm’s partners began privately questioning whether the emails reflected the level of discretion expected from a senior legal executive.

In highly regulated industries, reputational risk is often treated as seriously as financial risk. The optics of luxury gifts and friendly correspondence with a convicted sex offender proved difficult to ignore.

The Decision to Step Down

On Thursday, Ruemmler announced her resignation from Goldman Sachs, stating that her priority had always been the firm’s interests. In her public statement, she emphasized her work overseeing legal, reputational, and regulatory matters and reinforcing the firm’s commitment to integrity.

Goldman CEO David Solomon acknowledged her decision and said the company would allow her to transition out of the role gradually, with her departure set for June 30.

The firm stopped short of suggesting misconduct but faced growing external and internal pressure as more documents became public.

Media Review and Ongoing Scrutiny

The trove of documents was released by the U.S. Justice Department and reviewed in collaboration with journalists from CBS, NBC, MS NOW, CNBC, and The Associated Press. Each newsroom has conducted independent reporting based on the materials.

As more correspondence becomes public, the case continues to fuel debate about professional boundaries, ethical standards, and how associations with controversial figures can haunt even the most accomplished careers.

A Legacy Complicated

Kathy Ruemmler’s career once stood as a model of legal achievement — from corporate prosecutions to presidential counsel to one of Wall Street’s most powerful positions.

But as the narrative surrounding Gifts and Soup From ‘Uncle Jeffrey’: How Epstein Connections Derailed Kathy Ruemmler’s Bid at Goldman Sachs shows, reputation in high-level finance and politics can be fragile.

In industries built on trust and credibility, perception matters. And in this case, a trail of emails, gifts, and personal familiarity ultimately proved more powerful than a résumé filled with landmark victories.